Moody’s has raised its full-year forecast for sustainable bond issuance on the back of record volumes globally in the first half of the year, and now expects 2021 supply of labelled use-of-proceeds bonds and sustainability-linked bonds to approach $1tn.

Supply of labelled use-of-proceeds bonds reached $427bn (€363bn) in the first half of the year – more than double the $188bn of the same period last year – and the rating agency now anticipates for the fully year around $450bn in green bonds, and $200bn each in social bonds and sustainability bonds. Sustainability-linked issuance could meanwhile add more than $100bn.

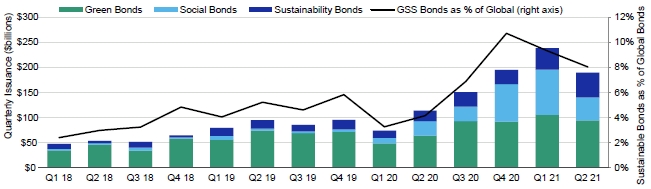

“Following record first-half issuance, we still expect sustainable bonds to account for around 8% to 10% of global debt issuance in 2021, as issuers across all segments of the market continue to explore how they can link their capital markets activities with their sustainability objectives,” said Moody’s analyst Matthew Kuchtyak.

Full-year supply of $850bn for green, social and sustainability bonds would represent a new annual record, 59% more than the $533bn issued in 2020.

Quarterly issuance of green, social and sustainability bonds 2018-2021

Sources: Moody’s Investors Service, Climate Bonds Initiative and Dealogic

Green bond volumes of $94bn in the second quarter were 10% lower than the $105bn of the first quarter, but 48% higher than the first quarter of 2020, Moody’s noted. The aggregate $199bn of green bonds in the first half was 78% up on the corresponding period of 2020, when the effects of the Covid-19 pandemic were pronounced and the resulting economic slowdown meant reduced green bond issuance.

Social bond issuance of $46bn in the second quarter was 49% lower than in the first quarter, but supply of $136bn in the first half nearly eclipsed the $144bn issued across 2020. Moody’s highlighted the concentration of social bond issuance in the hands of three big issuers – the European Union and French public finance agencies Caisse d’Amortissement de la Dette Sociale (CADES) and UNEDIC – and how their volumes – which fell from $78bn in the first quarter to $28bn in the second – affect supply.

“Nevertheless, we anticipate that social bonds will remain a viable alternative for issuers across a wide swath of sectors, especially as market standards continue to evolve and impact measurement techniques are refined,” the rating agency added.

Sustainability bonds set a new record of $49bn in the second quarter, up from $43bn in the first quarter and more than double the $21bn issued in the corresponding period of 2020. The $92bn issued in the first half of this year was more than 150% higher than the first half of last year.

“A greater focus on corporate sustainability and stakeholder capitalism will continue to support growth in sustainability bonds, with greater participation from a wide range of issuers aiming to highlight both their environmental and social objectives,” said Moody’s.

The second quarter also saw record volumes of sustainability-linked bonds (SLBs) and loans, with SLB supply of $31bn more than three times the $9bn issued in the first quarter.

“Although these structures are newer than their use-of-proceeds counterparts, issuance levels continue to surge because issuers increasingly view these instruments as viable sustainable debt alternatives that allow them to appeal to sustainability-minded investors, while maintaining the flexibility of debt issuance for general corporate purposes,” the rating agency said.

According to Moody’s, the development of market standards, ambitious corporate agendas, and strong investor demand are among factors supporting the growth of the SLB market. However, it highlighted challenges that could impede growth and credibility, including selection of key performance indicators (KPIs), robustness of sustainability performance targets (SPTs), and the relevance of instrument structure and financial characteristics selected by issuers.

“We anticipate investor scrutiny of these elements will only increase as the market continues to grow and mature,” the rating agency said.

Moody’s noted that in conjunction with the EU’s renewed sustainable finance strategy announced on 6 July, the European Commission has put forward a legislative proposal for an EU Green Bond Standard (EU GBS), aiming to create a “gold standard” for issuance in alignment with the EU Taxonomy that will be voluntary and open to all jurisdictions.

“While linking project eligibility to the detailed criteria and thresholds outlined in the EU sustainable finance taxonomy will likely build investor trust over time by allaying concerns around greenwashing,” it added, “the usability of the taxonomy is a potential impediment to widescale adoption of the EU GBS.”

Main composite image sources: Moody’s, Andrew Larsen/Flickr